Saliva Test for Breast Cancer

For middle-aged women, undergoing a mammogram has long been an uncomfortable yet crucial process for early detection of breast cancer. However, a groundbreaking development promises to simplify breast cancer screening to a mere saliva test. Researchers unveiled a novel hand-held biosensor capable of identifying breast cancer biomarkers from just a small saliva sample, as published on February 13 in the Journal of Vacuum Science & Technology B.

Lead researcher Hsaio-Hsuan Wan, a doctoral candidate at the University of Florida, heralds the device for its convenience and efficiency. “Our device is an excellent choice because it is portable — about the size of your hand — and reusable,” Wan stated. “The testing time is under five seconds per sample, which makes it highly efficient.”

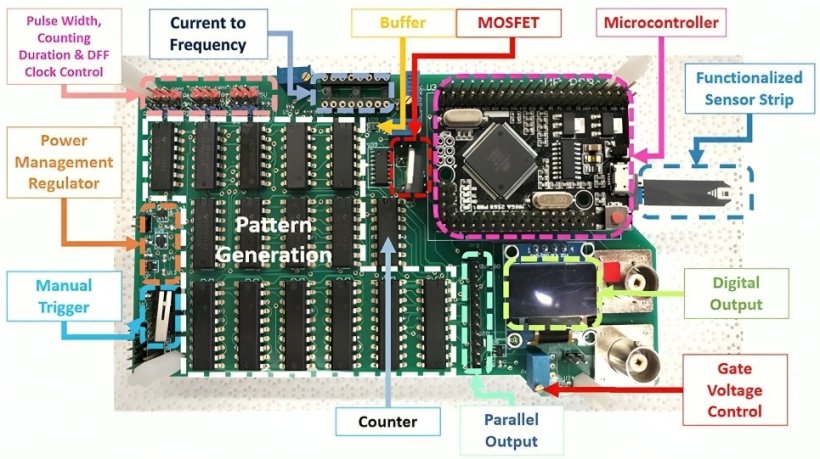

This innovative biosensor operates with paper test strips that are coated with specific antibodies targeting cancer biomarkers. Upon applying a saliva sample to the strip, the device sends electrical pulses that prompt the biomarkers to attach to the antibodies. This interaction changes the electrode’s output signal, enabling the device to assess cancer risk swiftly.

Contrasts this with traditional screening techniques like mammograms, ultrasounds, and MRI scans, which are not only expensive but also demand substantial equipment and expose patients to low doses of radiation. Wan highlighted the particular significance of this new technology for developing countries, where advanced diagnostic tools may be scarce. “Our technology is more cost-effective, with the test strip costing just a few cents and the reusable circuit board priced at $5,” she mentioned.

Remarkably, the biosensor can deliver precise results with a mere drop of saliva, detecting cancer biomarkers in concentrations as low as one-quadrillionth of a gram per milliliter. It specifically looks for biomarkers like human epidermal growth factor receptor 2 (HER2), which is linked to 15% to 20% of invasive breast cancers, and CA 15-3, an antigen associated with breast cancer.

In trials involving 21 human saliva samples, the device successfully differentiated between healthy tissue, early-stage breast cancer, and advanced breast cancer, based on these biomarkers. Wan expressed her enthusiasm for the device’s potential impact: “The highlight for me was when I saw readings that clearly distinguished between healthy individuals and those with cancer. We dedicated a lot of time and effort to perfecting the strip, board and other components. Ultimately, we’ve created a technique that has the potential to help people all around the world.”

This is an amazing development that could save many lives!